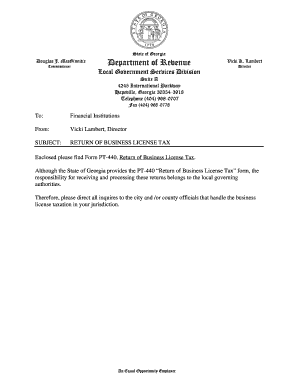

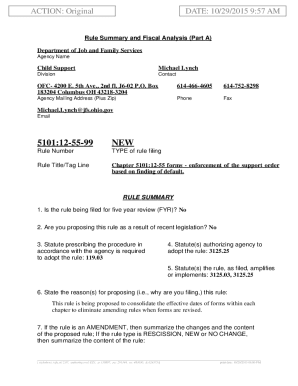

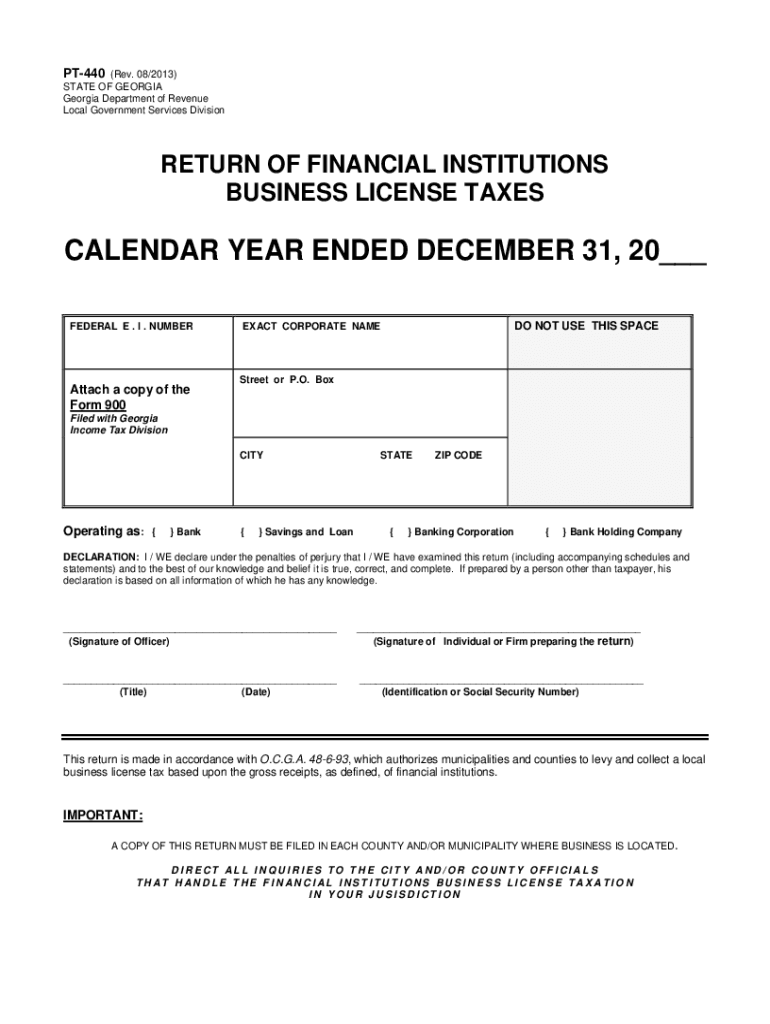

GA DoR PT-440 2013-2024 free printable template

Show details

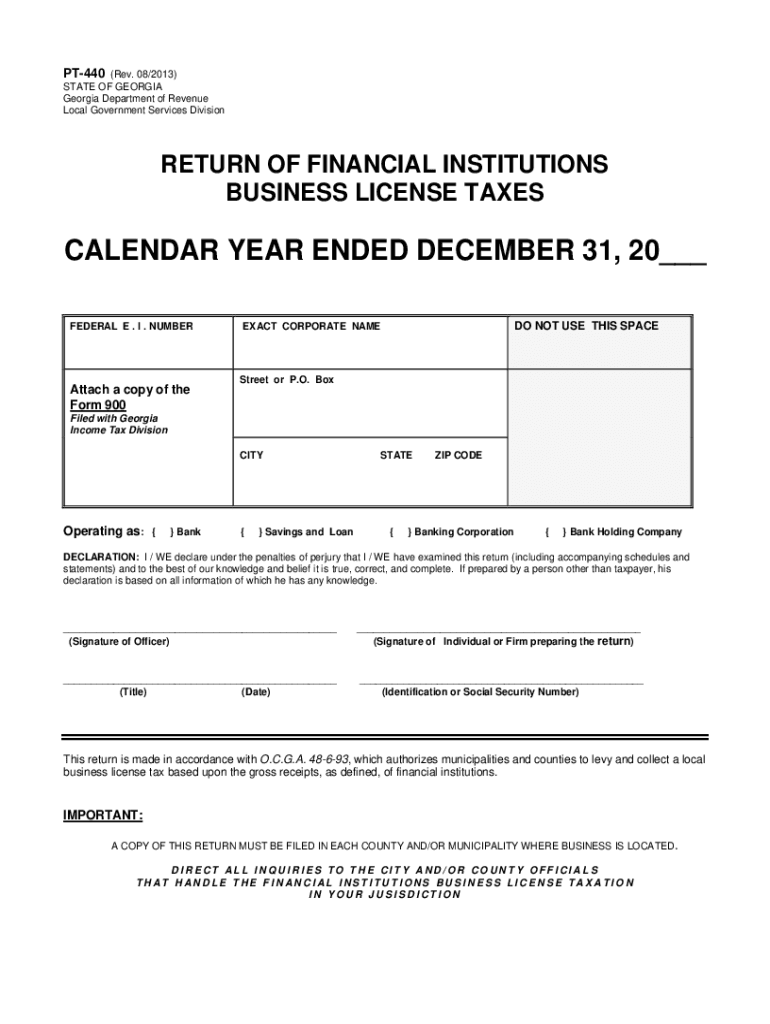

Copies of the Form PT-440 must be attached to the State excluding the principal Georgia office for each county and each municipality listed separately in column 1. Although the State of Georgia provides the PT-440 Return of Business License Tax form the responsibility for receiving and processing these returns belongs to the local governing authorities. PT-440---SCHEDULE 2 for institutions having 5 or fewer full service offices-in addition to the principal Georgia office On Line A enter the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax information georgia 2013-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax information georgia 2013-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax information georgia online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit return tax form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

GA DoR PT-440 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax information georgia 2013-2024

How to fill out Georgia business:

01

First, gather all necessary business information such as the business name, address, and contact information.

02

Identify the appropriate form needed to register a business in Georgia. This can be done by visiting the Georgia Secretary of State's website or contacting their office directly.

03

Complete the required sections of the form, providing accurate and up-to-date information. This may include details about the type of business entity, ownership structure, and any applicable licenses or permits.

04

Make sure to carefully review and double-check all information entered on the form to avoid any errors or omissions.

05

If required, include the necessary supporting documents such as a business plan, financial statements, or proof of identification.

06

Pay the applicable filing fee, which varies depending on the type and size of the business.

07

Submit the completed form and all supporting documents either online or by mail, following the instructions provided by the Georgia Secretary of State.

08

Wait for confirmation or approval from the Georgia Secretary of State's office. This may take a few days or weeks, depending on the volume of applications.

09

Once approved, make sure to obtain any additional licenses or permits required for your specific business activities in Georgia.

10

Finally, keep a copy of all filed documents and relevant receipts for future reference or compliance purposes.

Who needs Georgia business:

01

Entrepreneurs or individuals looking to start a new business in Georgia.

02

Existing businesses operating in other states or countries that wish to expand their operations into Georgia.

03

Individuals who have decided to convert their sole proprietorship or partnership into a formalized legal entity such as a corporation or limited liability company (LLC).

04

Business owners or professionals who want to take advantage of Georgia's business-friendly policies, incentives, or tax benefits.

05

Anyone engaging in business activities in Georgia that require registration or licensing, such as certain professions or regulated industries.

Video instructions and help with filling out and completing tax information georgia

Instructions and Help about return georgia form

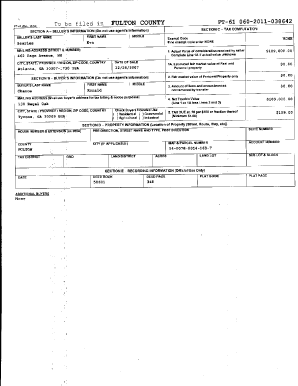

Fill georgia pt 61 form pdf : Try Risk Free

People Also Ask about tax information georgia

How should I categorize my LLC?

What type of LLC is most common?

Should you get EIN first or LLC first?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is georgia business?

Georgia is a state located in the southeastern United States. It has a diverse economy with various industries and sectors contributing to its business landscape. Some key industries in Georgia include:

1. Agriculture: Georgia is known for its agricultural production, including crops such as peanuts, cotton, pecans, and peaches. The state ranks high in the production of several agricultural products.

2. Manufacturing: Georgia has a strong manufacturing sector, with industries such as automotive manufacturing, aerospace, food processing, textiles, and paper products. Major manufacturing companies have operations in Georgia, contributing to the state's economy.

3. Film and Entertainment: Georgia has become a popular destination for film and television production, with Atlanta being dubbed the "Hollywood of the South." The state offers various tax incentives and a robust infrastructure for the entertainment industry.

4. Logistics and Transportation: Due to its strategic location, Georgia has a significant logistics and transportation industry. It is home to the busiest airport in the world, Hartsfield-Jackson Atlanta International Airport, and also has a well-developed rail and highway network.

5. Technology: Georgia has a growing technology sector, with Atlanta serving as a hub for tech startups and innovation. The state has a thriving ecosystem of technology companies, including software development, information technology services, telecommunications, and cybersecurity.

6. Tourism: Georgia attracts a significant number of tourists with its historical landmarks, coastal areas, national parks, and cultural attractions. Tourism contributes to the state's economy through hotels, restaurants, entertainment venues, and recreational activities.

These are just a few examples of the business sectors in Georgia. The state offers a range of opportunities for entrepreneurs, investors, and businesses to thrive in various industries.

Who is required to file georgia business?

Any individual or entity conducting business in Georgia is generally required to file a Georgia business tax return. This includes both resident and non-resident individuals, as well as corporations, limited liability companies (LLCs), sole proprietorships, partnerships, and trusts. Additionally, certain exemptions and thresholds may apply, so it is recommended to consult with a tax advisor or visit the official website of the Georgia Department of Revenue for specific filing requirements.

How to fill out georgia business?

To fill out a Georgia business form, such as an application or registration, follow these steps:

1. Obtain the correct form: Visit the Georgia Secretary of State's website or the appropriate government agency's website to find the specific form you need. Forms may vary depending on the type of business you wish to establish or the purpose of the form.

2. Gather necessary information: Before filling out the form, ensure you have all the required information and documents ready. This may include your business name, address, type of entity (LLC, corporation, partnership), owner(s) details, EIN (Employer Identification Number), and other relevant information.

3. Read the instructions carefully: Take your time to thoroughly read the instructions provided with the form. This will help you understand how to fill out the document accurately and save you from potential mistakes or delays.

4. Complete the form: Fill in all the required fields using correct and current information. This includes providing accurate and complete addresses, contact details, and any specific details requested for your business type.

5. Include supporting documents: Some forms may require you to attach additional documents such as certificates, licenses, or proofs of identity. Check the form instructions to determine if any supporting documents need to be included with your application.

6. Check for completeness and accuracy: Carefully review your filled-out form, ensuring all necessary sections are completed accurately. Double-check names, addresses, and numbers for correctness.

7. Sign and date the form: Once you have reviewed the form and are satisfied with its accuracy, sign and date it as required. Some forms may require multiple signatures, such as those from company members or authorized representatives.

8. Make copies: Before submitting the form, make copies for your records. These copies can serve as a reference and proof of your submission.

9. Submit the form: Follow the instructions on the form to determine the appropriate method of submission. This may include mailing the form to the designated address, submitting it online, or delivering it in person. Ensure that you include any required fees or payments with your submission.

10. Track and follow up: If applicable, keep a record of the submission and any confirmation numbers or receipts. Follow up with the appropriate government agency if you do not receive any confirmation or response within the expected timeframe.

Remember to consult with relevant authorities or seek professional guidance if you have any questions or concerns while filling out Georgia business forms.

What is the purpose of georgia business?

The purpose of a Georgia business is to provide goods or services in order to generate profit, contribute to the state's economy, create employment opportunities, and fulfill customer needs and demands. Additionally, Georgia businesses may also aim to innovate, drive economic development, and contribute to the overall societal well-being and growth of the state.

What information must be reported on georgia business?

In Georgia, businesses are required to report certain information to state and federal authorities. The specific information to be reported may vary based on the type of business entity and its activities. However, here are some common requirements:

1. Business Entity Formation: When forming a business entity such as a corporation, limited liability company (LLC), or partnership, certain information must be included in the formation documents filed with the Georgia Secretary of State. This typically includes the business name, registered agent, address, names and addresses of owners or managers, and any other required provisions.

2. Annual Reports: Most business types, such as corporations and LLCs, are required to file an annual report with the Georgia Secretary of State. This report typically includes updated information about the business, such as its current address, registered agent, and management structure.

3. Tax Information: Georgia businesses must provide tax information to the Georgia Department of Revenue and the Internal Revenue Service (IRS). This typically includes obtaining an Employer Identification Number (EIN) from the IRS and filing relevant tax returns such as Georgia state income tax, sales tax, and payroll taxes.

4. Licenses and Permits: Certain businesses in Georgia may require specific licenses or permits to operate legally. These requirements vary depending on the nature of the business activity and may include licenses such as professional licenses, liquor licenses, health permits, or zoning permits. Businesses are responsible for researching and obtaining the necessary licenses and permits applicable to their operations.

5. State and Federal Employment Reporting: If a business has employees, it must report specific information to state and federal agencies. This includes reporting new hires to the Georgia New Hire Reporting Center and completing and filing required payroll tax forms such as Form W-4 for federal income tax withholding and Form G-4 for Georgia state income tax withholding.

Note: The above information provides a general overview, but it is always recommended to consult with an attorney or a qualified business professional to ensure compliance with specific reporting requirements for your Georgia-based business.

What is the penalty for the late filing of georgia business?

The penalty for late filing of a Georgia business can vary depending on the specific type of filing and the circumstances. Here are a few common penalties:

1. Annual Report: Businesses in Georgia are required to file an annual report with the Georgia Secretary of State. The late filing penalty for the annual report is $25.

2. Sales and Use Tax: Businesses that collect sales tax in Georgia must file monthly, quarterly, or annual sales tax returns. The late filing penalty for sales and use tax returns can range from 5% to 25% of the tax due, depending on the number of days late.

3. Income Tax: Businesses in Georgia must file their income tax returns by the 15th day of the 3rd month following the close of their tax year. The late filing penalty for income tax returns is generally calculated as 5% of the net tax due per month or part of a month, up to a maximum of 25%.

4. Payroll Tax: If a business fails to file its payroll tax returns or pay the required payroll taxes, various penalties can apply. The specific penalty amount depends on factors such as the number of employees and the duration of noncompliance.

It is important to note that these penalties are subject to change, and it is advisable to consult with the Georgia Secretary of State or a qualified professional for the most up-to-date and accurate information regarding specific penalties.

How do I fill out the tax information georgia form on my smartphone?

Use the pdfFiller mobile app to fill out and sign return tax form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit georgia form pt 440 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form pt 440 georgia from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out georgia instructions on an Android device?

Use the pdfFiller app for Android to finish your pt 440 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your tax information georgia 2013-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Georgia Form Pt 440 is not the form you're looking for?Search for another form here.

Keywords relevant to georgia 440 form

Related to georgia pt 440

If you believe that this page should be taken down, please follow our DMCA take down process

here

.